Role Level = User

Overview

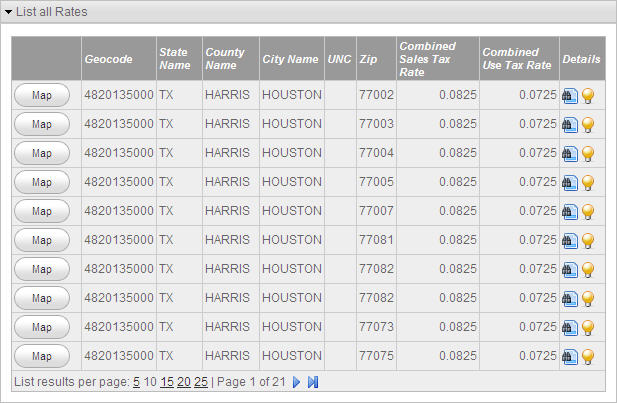

The List all Rates screen displays all tax rates for the selected State, County, City, and ZIP Code.

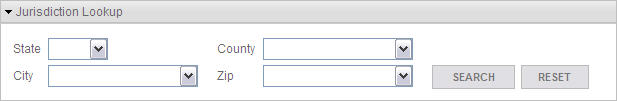

Jurisdiction Lookup Section

Description

Select the desired jurisdictions to display all tax rates for the jurisdiction. A State must be selected to populate and select a County and/or City. Both a State and City must be selected to populate and select a ZIP Code. Leave all fields empty to display all tax rates.

Fields

Field |

Definition |

State |

Use the drop-down list to restrict the displayed tax rates to only the selected State. |

County |

After selecting a State, this drop-down list will be populated with every County in the selected State. Use this drop-down list to restrict the displayed tax rates to only the selected County. |

City |

After selecting a State, this drop-down list will be populated with every City in the selected State. If a County is also selected, then the list will be further restricted to only Cities in the selected County. Use this drop-down list to restrict the displayed tax rates to only the selected City. |

Zip |

After selecting a State and City, this drop-down list will be populated with every ZIP Code in the selection. Use this drop-down list to restrict the displayed tax rates to only the selected ZIP Code. |

Buttons

Button/Icon |

Function |

|

Click to clear the selections in the Jurisdiction Lookup section. |

|

Click to search for tax rates based on the Jurisdiction Lookup selections. |

List all Rates Section

to create a Location that maps to the respective Geocode. Click

to create a Location that maps to the respective Geocode. Click  to view details about the respective Geocode. Move the mouse over

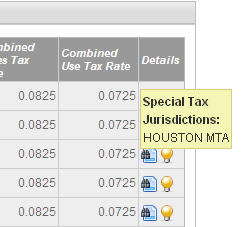

to view details about the respective Geocode. Move the mouse over  to display a popup of all Special Tax Jurisdictions for the respective Geocode.

to display a popup of all Special Tax Jurisdictions for the respective Geocode.

Button/Icon |

Function |

|

Click to display the Create new Location screen to create a new Location that maps to the respective Geocode. |

|

Click to display the Tax Rate Summary screen for the respective Geocode. |

|

Move the mouse over this icon to display a popup of all Special Tax Jurisdictions for the respective Geocode. |

|

Click to display the first page of tax rates. |

|

Click to display the previous page of tax rates. |

|

Click to display the next page of tax rates. |

|

Click to display the last page of tax rates. |